Starting a credit repair business in South Africa involves understanding local credit scoring systems and collaborating with specialists to help individuals improve their credit scores. Registered businesses must define niches, implement digital marketing strategies, offer free consultations, and structure transparent pricing for various packages tailored to client needs and budgets. Key terms: Credit Repair Specialist, Credit Score Repair, Credit Repair Agency, Credit Repair Services, Credit Repair Fees.

Starting a credit repair business in South Africa can be a rewarding venture for the right candidate. This comprehensive guide is designed to equip aspiring credit repair specialists with the knowledge needed to establish and thrive in this sector. We’ll explore the role of a credit repair specialist, walk through the legal considerations and setup process, and provide insights into pricing your services effectively. From understanding credit score repairs to navigating as a reputable credit repair agency, this guide is your starting point.

- Understanding Credit Repair: A Specialist's Perspective

- Setting Up Your Credit Repair Business in South Africa

- Pricing Your Credit Repair Services: Fees and Packages

Understanding Credit Repair: A Specialist's Perspective

Starting a credit repair business in South Africa involves understanding the intricate landscape of credit scoring and the role of specialists in this field. A credit repair specialist is an expert who helps individuals improve their credit scores by addressing errors, disputes, and negative information on their credit reports. These professionals offer tailored credit repair services aimed at enhancing clients’ financial health. They work closely with credit bureaus, agencies, and lenders to navigate complex processes, ensuring clients receive accurate credit assessments and fair treatment.

Credit repair agencies in South Africa charge fees for their services, which may vary based on the extent of the issue and the desired outcome. These fees cover the research, negotiation, and legal actions required to remove inaccuracies or resolve debt-related problems. Some agencies offer packages that include credit report analysis, dispute management, and education on responsible financial practices. Understanding the market dynamics and legal frameworks around credit repair is crucial for anyone looking to establish a successful credit repair business in this space.

Setting Up Your Credit Repair Business in South Africa

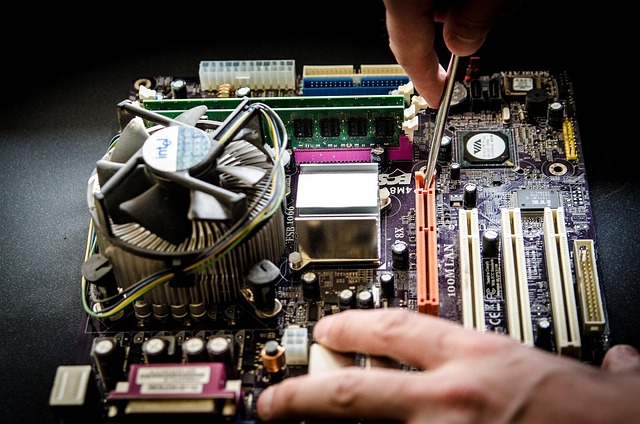

Starting a credit repair business in South Africa involves several crucial steps to establish yourself as a reputable credit repair specialist. Firstly, register your business with the relevant authorities, obtaining the necessary licenses and permits. This ensures compliance with local regulations and allows you to legally offer credit score repair services. Next, define your niche within the industry; specialise in certain types of credit repair or target specific demographics for a more tailored approach.

Creating a comprehensive marketing strategy is essential to attract clients seeking credit repair services. Utilise digital platforms and social media to reach potential customers, highlighting your expertise and the benefits of your services. Transparency is key; clearly communicate your credit repair fees and the process you’ll follow to improve their credit scores. Build trust by offering free consultations or initial assessments to showcase your dedication to delivering effective credit score repair.

Pricing Your Credit Repair Services: Fees and Packages

Pricing your credit repair services is a crucial step in establishing your business. As a credit repair specialist or agency, you’ll want to create packages that cater to different client needs and budgets. Start by assessing the typical costs involved in improving a client’s credit score, including data access fees, dispute resolution charges, and any external service expenses. These will form the basis of your pricing structure.

Consider offering various tiers or packages: a basic package for clients seeking minor adjustments, a standard package for moderate improvements, and a premium package for extensive credit score repair. Each package can have different fee structures, with potential add-ons available for specialized services. Remember, transparency is key; clearly communicate your pricing, what’s included in each package, and any additional costs to ensure client satisfaction and build trust as a reputable credit repair agency.